Price Impact and Slippage

When buying or selling through a subnet (liquidity) pool, there is an inherent loss of value during the purchase called Price Impact.

Additionally, there can be unexpected changes to the price (due to other trades, or factors that change the subnet price. This is known as Slippage.

The larger the purchase amount, the higher the price impact

The smaller the liqudity pool, the higher the price impact.

What is Price Impact?

Due to the limited resources of the liquidity pool, any change in the ratio of tao/alpha will effect the price and exchange rate. The act of making a purchase through the subnet pool changes the ratio, and effects the rate at which the exchange is placed.

Price Impact occurs when staking AND unstaking alpha.

What is Slippage?

Slippage occurs when additional changes effect the subnet price, and chnage the amount of tao/alpha received. For example, a transaction may have 0.5% Price Impact but another stake occurs, changing the price, adding a 0.25% Slippage. The entire change is Price Impact + Slippage (in our example (0.75%).

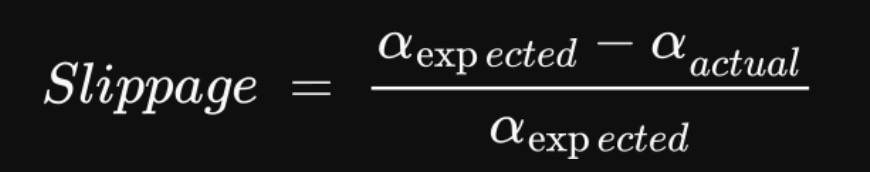

Price Impact & Slippage formulas

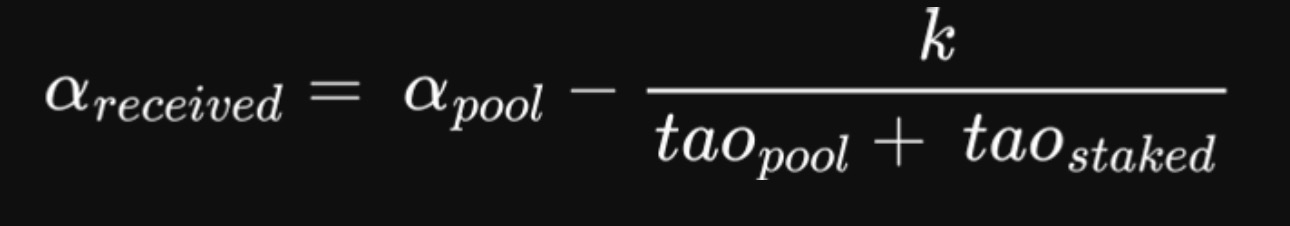

The tao/alpha conversion price cannot be used to calculate a transaction. You must use the following equation to determine the α_received:

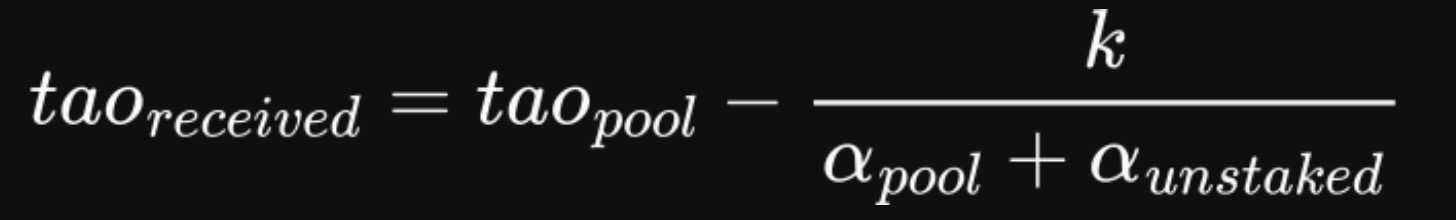

The opposite occurs when unstaking alpha to buy tao:

The amount received will be less than the amount expected from the direct price conversion. The difference is denoted as slippage+price impact (generally shown as a percentage):

NOTE: Slippage is calculated slightly differently in subnets with Uniswap Subnet Pool Liquidity activated. The basics still hold, but if buying and selling in a range with a lot of liquidity, the sippage will be lower than the calculations above.

Price Impact Calculator

Live Subnet Slippage Calculator

Example 1 (large purchase = large price impact):A subnet pool has 100α and 100τ. alpha:tao is 1:1, so the alpha price is 1 tao.

A tao holder wishes to sell 1,000 tao for alpha. Following the exchange rate of 1:1, you might assume 1,000α would be received. But there is just 100α in the pool, so using the equation above 90.9α is received.

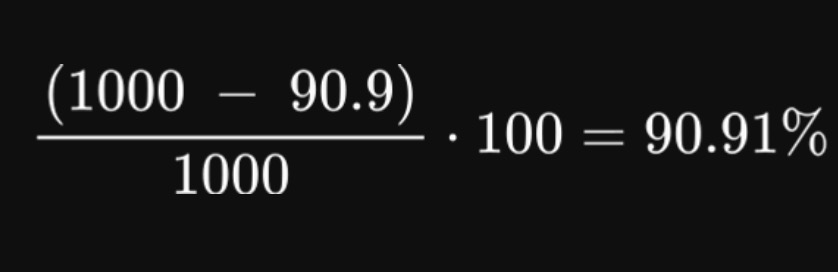

This results in a price impact of 90.91%:

Large purchases of tao or alpha will have large amounts of price impact.

Example 2 smaller purchaseA subnet pool has 100α and 100τ. alpha:tao is 1:1, so the alpha price is 1 tao.

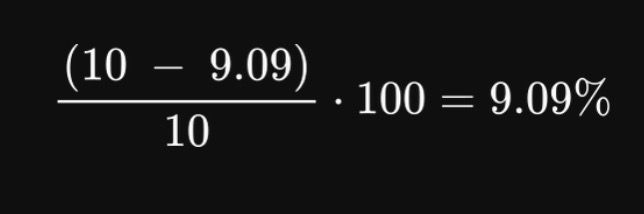

A tao holder wishes to sell 10 tao for alpha. Using the equation for alpha_expected, they will receive 9.09α.

This results in 9.1% price impact.

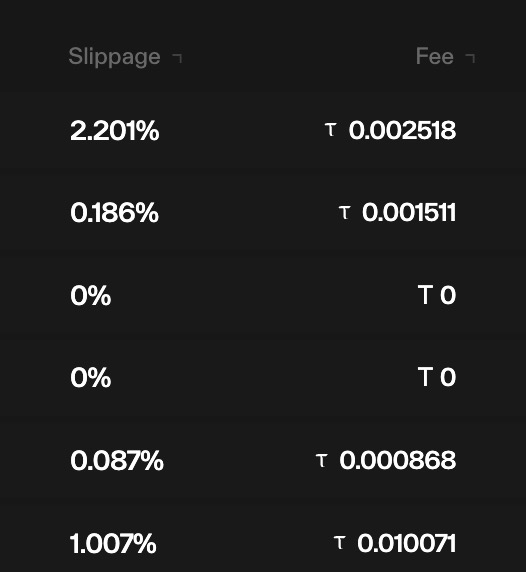

Price impact and Slippage values

The transaction tables list the actual slippage of a transaction. A negative slippage means your transaction actually profited from the trade

Updated about 1 month ago