Emissions for Validators

How we got here

How are emissions calculated for Validators?

Terms to know

VTrust

- Validators test miners and create a weighted list of scores. These are submitted to the Yuma consensus.

- These scores are compared to the other validators - and each validator is judged to be in consensus with the rest of the validators.

If a Validator is judged to be out of consensus, their VTrust (validator trust) will decrease. VTrust is a value between 0 and 1, where 0 is terrible, and 1 is perfect.

The other value in the determination of validator emissions is the stake weight. Validators with higher stake weight will receive higher emissions.

- root_stake: The amount of tao staked to a validator on root.

- tao_weight : Defined on chain as 0.18.

- alpha_stake: The amount of alpha staked to a validator on the subnet

- total_stake: The value used to determine emissions.

Dividends

Dividends are the percentage of the total validator emissions that will be given to each validator. It is calculated from VTrust and total_stake. High stake & high VTrust lead to high dividends. High dividends yield high emissions.

- The sum of all dividends on a subnet is 1.

- Dividend score is calculated once per tempo (360 blocks for most subnets).

Calculating Validator Emission

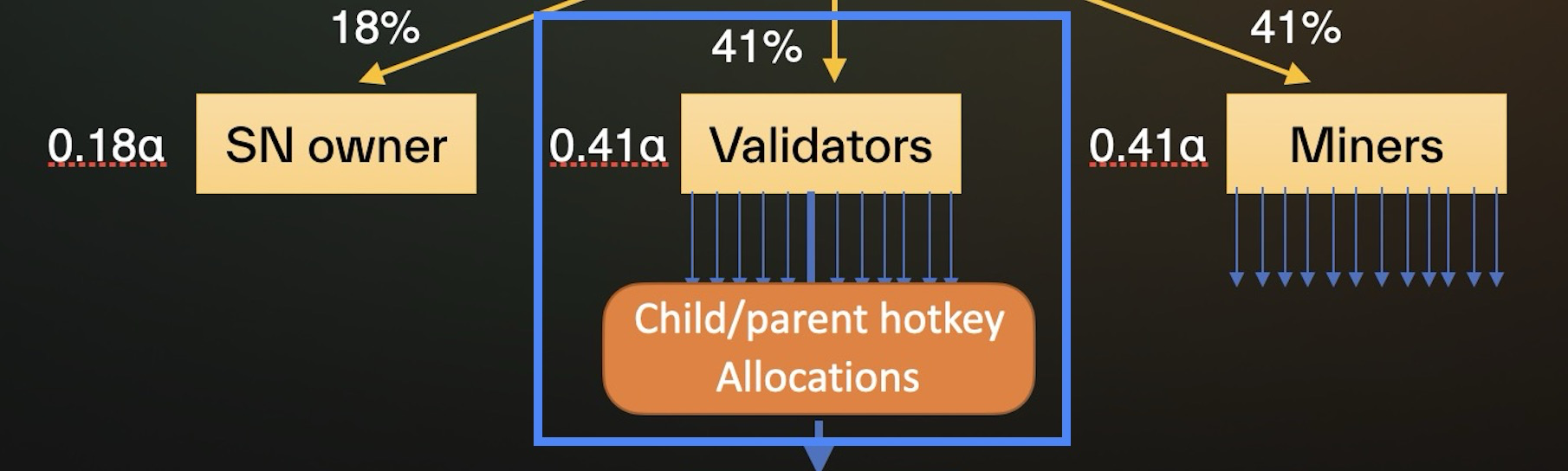

- Validators receive 41% of the

alpha_outsubnet emission. - The validator's dividend score gives the fraction of the Validator alpha that is awarded.

Emission math exampleA subnet receives 1

alpha_outper block.In 1 epoch - 1*360 = 360 alpha.

Validators receive 41% of the subnet' emissions. 360*.41 = 147.6 alpha

Validator x has dividends of 0.006. 147.6*0.006 = .8856 alpha per epoch.

Validator x has 0.8856 alpha emission.

If this validator has parent hotkeys this will be divided amongst the validators based on the stake (see Emission for Parent/Child Hotkeys).

This will then be divided into root emission (and converted into tao) and alpha emission (see )Emissions: Root vs. Alpha Stake.

Validator rewards

We have calculated the emission to the validator, but this is further split by several factors:

- Parent hotkeys receive their percentage of the stake.

- The validator may take a

child_takefrom this emission.

- The validator may take a

- Each Subnet has a root: alpha proportion that divides the emissions.

- Both alpha and root proportions may have a validator take.

- This is the reward for the validator.

- The remaining root and alpha reward is divided amongst stake nominators.

Next Steps

- Emission for Parent/Child Hotkeys: Dividing dividends to parent/child hotkeys.

- Emissions: Root vs. Alpha Stake Dividing between root & alpha proportions.

- Stakeholder Emissions: Root & Stakeholder Emissions: Alpha: distribution of emissions to stakeholders.

Updated 9 months ago